Phishing Alert: Scam emails claiming to be from CAA/AAA are offering a fake “Car Emergency Kit” prize. Do not click the link or share personal info. You can report to the Canadian Anti‑Fraud Centre: 1‑888‑495‑8501.

CAA members save up to 15%*

Are you travelling out of your province? Or out of the country?

Whether you’re travelling abroad or within Canada, unexpected situations can lead to substantial out-of-pocket expenses. From medical emergencies to trip cancellations and lost luggage, these kinds of mishaps can easily put a wrench in your travel plans, and they come at a cost. That’s right – even while travelling within Canada you would only be, at most, partially covered if an accident or cancellation were to occur.

CAA Travel Insurance offers comprehensive coverage plans for domestic and international travel, giving you peace of mind anywhere you go. And bonus, CAA members benefit from exclusive savings on rates! Learn more about CAA Travel Insurance below or contact a Travel Advisor.

Take the stress out of travelling, knowing you’re covered.

Travel Insurance Benefits

Filling Coverage Gaps

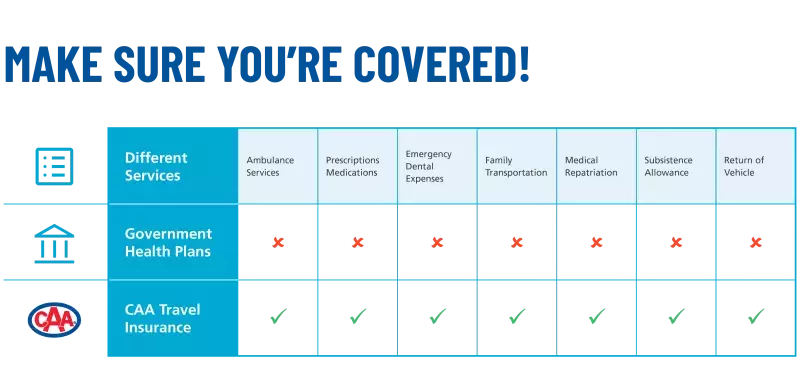

Even if you’re traveling within Canada, your provincial health plan or credit card may not cover all medical expenses when you’re in another province. CAA Travel Insurance helps fill those gaps.

Comprehensive Coverage

CAA Travel Insurance offers coverage on things like ambulance services, prescription medications, emergency dental expenses, family transportation return of vehicle and more.***

Exclusive Discounts

Enjoy peace of mind while traveling, knowing you're protected. As a CAA member, you can take advantage of up to 15%* savings on travel insurance. Wander more, worry less.

Trusted Provider

CAA Travel Insurance is underwritten by Echelon Insurance, a CAA Company, ensuring reliable and trustworthy coverage, and delivering exceptional service and value.

Because we know things can happen

CAA coverage always includes:

Emergency dental expenses

Emergency return of vehicle

Emergency family transportation

Emergency medical repatriation

Escort and return of insured children

Medical coverage up to $5 million** (CAD)

CAA membership has its advantages

Members save up to 15% on travel insurance*

Unique options for travelling within Canada

One year of travel coverage for one low cost

|

Read our policy guide for full details English French Disclaimer - All Emergency Medical Insurance benefits are subject to the terms, conditions, limitations and exclusions of the policy. The Multi-Trip plan covers individual trips for the number of days for the plan you have purchased. If your trip outside Canada exceeds the Multi-Trip plan days, a Top-Up plan is required for the additional days (coverage is automatically extended without additional premium for trips solely in Canada). The total number of trip days in a plan year may not exceed the number of days that your GHIP covers you out of your province or territory of residence unless you receive written approval from your GHIP to cover your entire trip days. CAA Travel Insurance, an Orion Travel Insurance product, is underwritten by Echelon Insurance. Certain exclusions, limitations and restrictions apply. A Medical Questionnaire may be required if you are 60 years of age and older. *Applies to CAA Members in good standing. Ten percent (10%) savings applies to the total premium excluding applicable taxes for Classic and Plus Members. Fifteen percent (15%) savings applies to the total premium excluding applicable taxes for Premier Members. Excludes web purchases. Excludes Visitors to Canada Insurance. **Up to $5 million CAD. Maximum $25,000 for all Emergency Medical Insurance benefits for Canadian residents without active Government Health Insurance Plan (GHIP); and/or without GHIP authorization to cover trip days exceeding the days GHIP Covers outside your province or territory of residence. ***Comprehensive Coverage: If part of a medical emergency, prescription medication is included. However, it excludes any medication you are currently taking for a known medical condition. We offer prescription assistance; if you lose your prescription, we help you get it replaced by a pharmacist at your travel location. However, the cost is paid by the insured. Policy conditions and limitations apply. |